|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring Low Cost Home Refinance Options for HomeownersRefinancing your home can be a strategic financial decision, especially when looking to lower your monthly mortgage payments or alter the loan term. Let's explore some low cost home refinance options that can help you save money. Understanding Home RefinanceHome refinancing involves replacing your existing mortgage with a new one, typically to take advantage of lower interest rates or different loan terms. The primary goal is to reduce your monthly payments or pay off your loan faster. Benefits of Refinancing

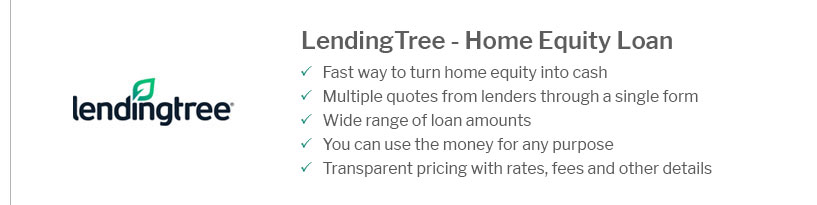

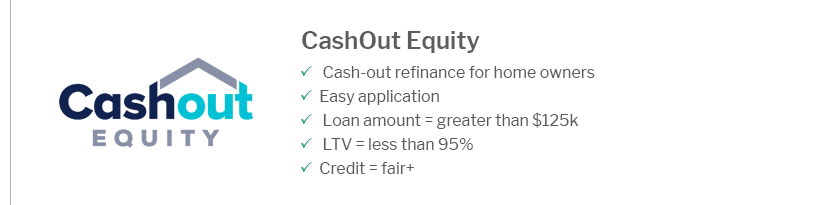

Popular Low Cost Refinance OptionsRate-and-Term RefinanceThis option involves changing the interest rate, loan term, or both. It's the most common type of refinancing, often used to achieve a lower interest rate. Streamline RefinanceDesigned for FHA, VA, and USDA loans, streamline refinancing allows homeowners to refinance with less paperwork and lower fees. It's a great option for those looking to reduce their interest rate with minimal hassle. Cash-Out RefinanceWhile typically associated with higher costs, cash-out refinancing can be a low cost option if you have significant home equity. It allows you to refinance your mortgage for a higher amount and take the difference in cash. Factors to ConsiderWhen evaluating refinance options, consider the following:

Eligibility and ProcessEligibility for refinancing depends on various factors including credit score, home equity, and current mortgage terms. The process typically involves:

Frequently Asked QuestionsWhat is the best low cost refinance option for first time home buyers?For first time home buyers, first time home buyer lenders may offer favorable rates and terms. Streamline refinancing is often a good choice due to reduced fees and paperwork. How can I ensure my refinance is truly low cost?To ensure a low cost refinance, compare interest rates and closing costs from multiple lenders. Look for options that offer no or low closing costs and consider the overall savings over the loan term. Does refinancing affect my credit score?Refinancing may temporarily impact your credit score due to the hard inquiry and new loan account, but it can improve over time as you make consistent payments. https://www.jvmlending.com/loan-types/no-cost-refinance/

A no cost refinance allows you to refinance your home without having to pay any money out-of-pocket for your closing costs. It is ... https://www.nerdwallet.com/best/mortgages/refinance-lenders

Rocket Mortgage, LLC: Best for highly rated mobile app - First Federal Bank: Best for variety of refi types - Rate: Best for fast preapproval ... https://www.bankrate.com/mortgages/low-cost-refinance/

You may find a lender advertising a low-fee refinance, which could be a great option for you. Just know that some lenders may charge less fees, ...

|

|---|